January 25, 2016

How to read highest high value of future bars

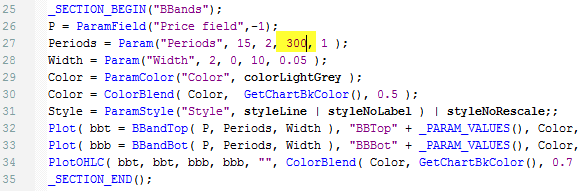

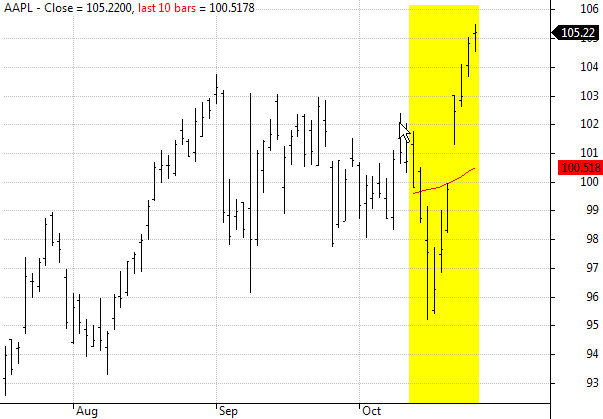

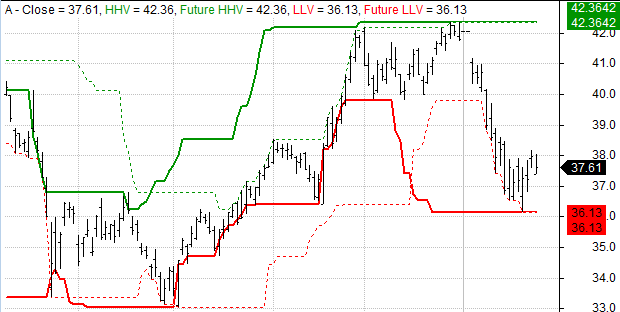

Built in HHV and LLV functions allow to read highest high or lowest low of n-past bars. If we want to refer to future values, there is an easy way to do it using simple Ref function and just shift HHV or LLV reading from N-bars ahead. A ready to use function showing such approach is presented below:

// function definitions

function futureHHV( array, periods )

{

return Ref( HHV( array, periods ), periods );

}

function futureLLV( array, periods )

{

return Ref( LLV( array, periods ), periods );

}

// sample use

Plot( Close, "Close", colorDefault, styleBar );

Plot( HHV( H, 20 ), "HHV", colorGreen, styleDashed );

Plot( futureHHV( H, 20 ), "Future HHV", colorGreen, styleThick );

Plot( LLV( L, 20 ), "LLV", colorRed, styleDashed );

Plot( futureLLV( L, 20 ), "Future LLV", colorRed, styleThick )And here is the chart produced by the formula above:

Filed by Tomasz Janeczko at 7:25 am under Indicators

Filed by Tomasz Janeczko at 7:25 am under Indicators

Comments Off on How to read highest high value of future bars