April 25, 2016

Support response times

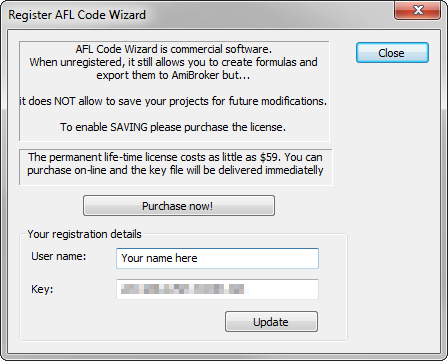

AmiBroker’s technical support staff everyday faces with very wide scope of subjects ranging from simple installation, lost registration details, password reminders questions to complex things like C++ programming or esoteric issues that occur say once a month or only when program is loaded with dozens of gigabytes of data.

Support response times to those different inquiries obviously vary a lot.

Technically we answer basic questions in 24 hours on week days (Monday-Friday).

Very simple questions get answered even in minutes if you happen to ask them when our support staff is in the office (we are in GMT+1 timezone). If you are in different time zone, we may be currently sleeping so you may need to wait for next day.

This response time applies to questions that are covered already in our Official Knowledge Base, Users’ Knowledge Base, Users’ Manual or internal documentation/resources. It is quite good idea to check those resources yourself as you are very likely to find the answer much quicker.

For more complex questions that need some formulas to be written or checked/verified the response time may be higher (48 hours), as long as this check can be done by our regular support staff.

Some complex issues/questions can not be solved/answered by support staff alone and then they are escalated to development. You need to keep in mind that development is 100% busy all the time, we are not sitting here doing nothing. It is all-day development job that is on-going and those complex support issues must wait in the queue. Also since some of issues/questions require lots of work (setting up environment to mimic customer’s setup, testing, single-step debugging sessions, going through millions of lines of code), it may easily take days or even weeks to complete. If development finds out that the issue is due to software problem, then the problem is either fixed at once or scheduled for fixing. This is a process. So please do not expect “next day response” for those kind of issues. You are also not going to get constant e-mails/updates like “we are working on it”, because we are always working on something in the queue. Please be patient, things are being worked on constantly.

Filed by Tomasz Janeczko at 9:43 am under Uncategorized

Filed by Tomasz Janeczko at 9:43 am under Uncategorized

Comments Off on Support response times