January 29, 2016

Ruin stop or mysterious Short(6) in the trade list

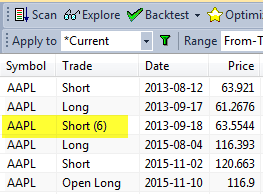

When you back-test a trading system, you may sometimes encounter trades marked with (6) exit reason, showing e.g.: Short (6) or Short (ruin) in the trade list as in the picture below:

As explained in the this Knowledge Base article: http://www.amibroker.com/kb/2014/09/24/how-to-identify-which-signal-triggers/ such identifier tells us that the trade was closed because of the ruin stop activation.

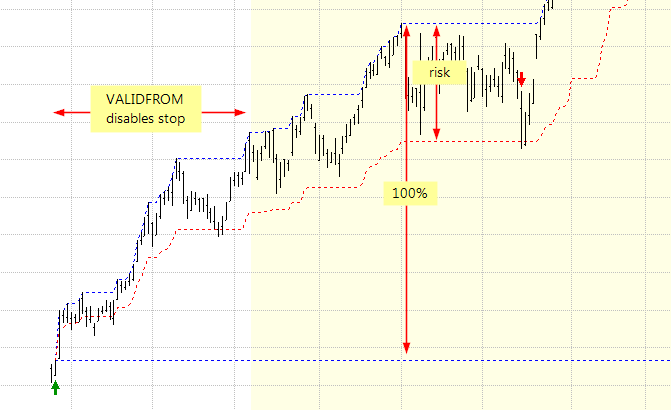

A ruin-stop is a built-in, fixed percentage stop set at -99.96%, so it gets activated if your position is losing almost all (99.96%) of its entry value. It almost never occurs in long trades, but it may be quite common if your trading system places short trades without any kind of maximum loss stop. Imagine that you short a stock when its price is $10, then it’s price rises to $20 (twice the entry price). When you buy to cover the position you must pay $20 per share, which means that your loss on this trade is $10 per share ($20-$10). This means 100% loss (as per entry value). If you placed such a trade with all your capital you would be bankrupt. That is why this stop is called “ruin stop”. Unfortunately, by the nature of short selling, the gains are limited to 100% (when stock price goes down to zero) but losses are virtually unlimited.

So what to do to prevent exits by ruin stop?

The best idea is to just place proper max. loss stop at much smaller percentage (such as 10% or 20%) depending on what your risk tolerance is, to limit drawdowns and decrease the chance of wiping your account down to zero.

If, for some weird reason, you want to turn OFF this built-in stop, you can do so using this code:

SetOption( "DisableRuinStop", True )but it is highly discouraged, because when you wipe your account down to zero (or even below zero) it makes no point to run back-test any further. Instead of disabling this feature you should place proper, tighter maximum loss stop.

Filed by Tomasz Janeczko at 4:04 pm under Stops

Filed by Tomasz Janeczko at 4:04 pm under Stops

Comments Off on Ruin stop or mysterious Short(6) in the trade list